Decoding The Business Name

May 21, 2023

TLDR:

In the rapidly evolving business landscape, assessing a company's risk profile is vital yet challenging. Commercial lenders and insurers often grapple with inadequate business databases, time-consuming manual processes, and the complexity of real-time decision making. BusinessMatch stands out as a data-driven solution that leverages one of the world's largest business databases and innovative matching algorithms to provide comprehensive, accurate, and swift business insights. By automating industry classification and offering essential firmographics, it enables more efficient risk profiling. Pilot tests with commercial lenders and insurers underscore its effectiveness, even for 'invisible' businesses with limited online presence. BusinessMatch promises a more streamlined, accurate, and cost-effective risk profiling process in the modern commercial risk management.

The Universe of Commercial Risk Profiling

In the dynamic world of business, understanding a company's comprehensive risk profile is a challenging task. Insights such as industry classifications and firmographic data enable stakeholders to make informed decisions. These insights are particularly crucial for commercial lenders and insurers, who assess potential risks before partnering with businesses.

However, this problem presents formidable challenges. A lack of comprehensive business databases and the daunting task of business entity resolution (finding optimal linkages between disparate databases) often result in less accurate insights. This issue particularly affects small businesses with limited public visibility. These difficulties can restrict such businesses from accessing credit and commercial insurance, despite potentially being profitable and reliable partners.

Today’s Challenges

Currently, commercial lenders and insurers grapple with accurately classifying approximately 30%+ of their portfolios. This struggle often results in fewer funded loans and inadequately underwritten insurance policies. Additionally, manual underwriters can spend up to ten minutes per application just to find an appropriate industry code. The process is not only labor-intensive and expensive but also prone to human error.

Furthermore, even with comprehensive databases at hand, accurately identifying a specific business from these massive datasets remains a significant challenge. The task becomes even more complex when the need is for real-time and low-latency data, as in sectors like commercial lending and commercial insurance.

Introducing BusinessMatch: A Comprehensive Solution to Affordable Accuracy

Recognizing these hurdles, BusinessMatch has been meticulously developed over the last four years to address these challenges. BusinessMatch utilizes one of the world's largest business databases, amalgamating public web data, secretary of state filings, local government agencies' databases, public IRS data, and more to provide swift and accurate business insights. We use a variety of natural language processing (NLP) techniques and pretrained large language models (LLMs) to reliably extract the desired data points from these vast amounts of textual and tabular data. BusinessMatch's innovative and proprietary matching algorithms allow it to pinpoint an optimal match for a business based solely on its name and a zip code, if available. This system delivers a multitude of insights in a fraction of a second (average latency < 500 milliseconds), thereby facilitating real-time risk profiling and decision-making.

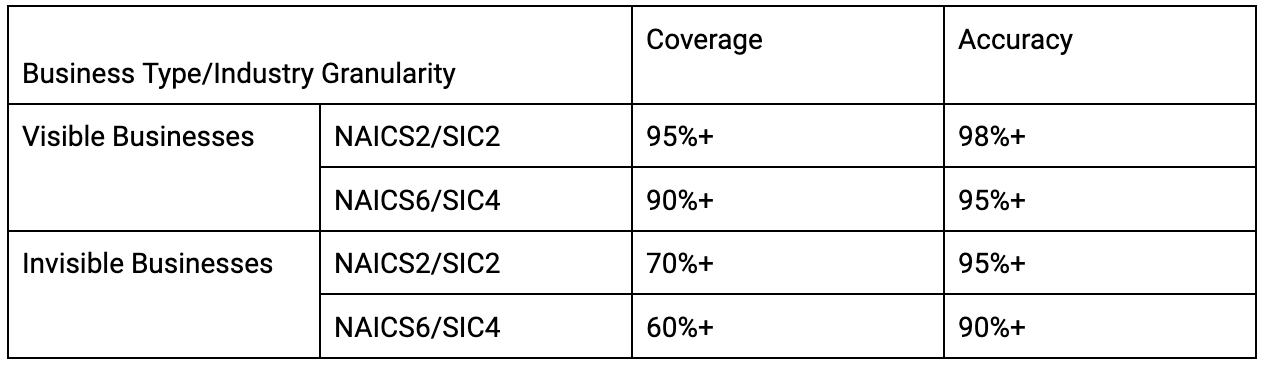

Based on numerous tests with commercial lenders and insurers, BusinessMatch has proven to be effective not only for visible businesses with readily accessible public data but also for 'invisible' businesses that have no online presence, such as a website or social media profiles. The following statistics provide a snapshot of BusinessMatch's performance in identifying accurate industry codes, based on the most recent dozen pilot tests:

Use Cases: Empowering Commercial Risk Profiling

BusinessMatch enables an automated, efficient approach to a traditionally cumbersome and error-prone industry classification process:

- For commercial lenders and insurers, it substantially alleviates the struggle to classify a significant portion of their portfolios and reduces the time manual underwriters spend identifying an industry code.

- BusinessMatch also incorporates 'IndustryGuard', a powerful feature that flags businesses that may misrepresent themselves on applications by omitting critical information or using ambiguous business names. This feature adds a robust protective layer, proving crucial in marketing and risk underwriting scenarios.

While the industry code is an important driver, it is only one aspect of understanding the multifaceted realm of business risk. To fully understand the risk profile, one must also consider various other indicators of business health.

- BusinessMatch aids in this by delivering essential firmographics, including operation status, business age, website and social media addresses, headcount, revenue, and more.

- BusinessMatch also provides details on existing and past financial obligations, which we will explore more thoroughly in our upcoming blog posts.

These data points have been proven to be reliable indicators of current business size and financial health and can be utilized throughout the risk profiling journey.

Moreover, BusinessMatch doesn't just provide real-time data; it also provides forward-looking indicators of size and financial health:

- BusinessMatch furnishes information on planned future layoffs, 60+ days ahead of their occurrences.

- It also enables the early detection of business expansion or contraction signals by providing accurate data on business job posting activities.

This type of data offers near real-time signals, critical for portfolio health monitoring, and early detection of businesses potentially facing imminent risks.